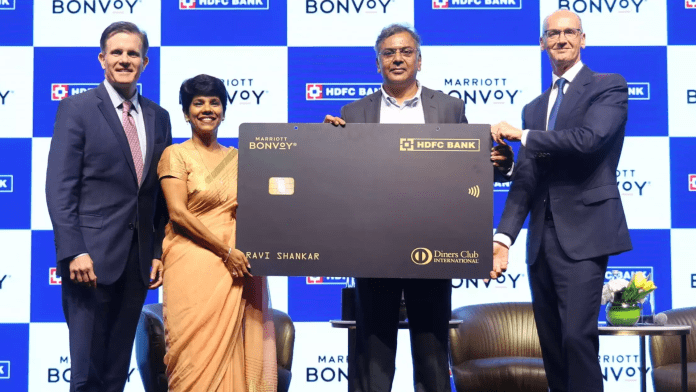

HDFC Bank has announced its partnership with Marriott Bonvoy to introduce India’s first co-branded hotel credit card, named the ‘Marriott Bonvoy HDFC Bank Credit Card’. Playing a pivotal role in this collaboration, Diners Club, a prominent member of the Discover Global Network, will function as the card’s designated network partner.

Blending the capabilities of both entities, the HDFC Bank Marriott Bonvoy credit card presents customers with an exceptional assortment of travel perks. These encompass Silver Elite Status within the Marriott Bonvoy framework, granting access to benefits like prioritized late checkout, exclusive member rates, additional Marriott Bonvoy bonus points, and a range of other privileges.

Parag Rao, the Country Head of Payment Business, Consumer Finance, Technology, and Digital Banking at HDFC Bank, holds the perspective that the card’s unveiling aligns perfectly with the current scenario. He points out that in the aftermath of the pandemic, there has been a notable surge in what is termed ‘revenge spending’ among Indians. This trend indicates a heightened focus on extracting enhanced experiences from their travel activities.

The collaborative card delivers a plethora of advantages, including a complimentary night award valued at a maximum of 15,000 points. This award can be redeemed at select Marriott Bonvoy hotels across the globe, within a span of one year. Moreover, the card extends Silver Elite Status, accompanied by the benefit of receiving ten elite night credits on a yearly basis. As cardholders meet designated spending criteria, they also have the opportunity to secure up to three extra complimentary nights at participating hotels.

Customers who hold the card will be able to accumulate eight Marriott Bonvoy points for every INR 150 spent on qualifying purchases made at participating Marriott Bonvoy hotels (excluding Homes and Villas). This earning rate is applicable for monthly expenses up to INR 10 lakh. Additionally, they can gather four Marriott Bonvoy points for every INR 150 spent on eligible travel, dining, and entertainment transactions, with a cap of INR 5 lakh per month.

Cardholders who are already earning eight Marriott Bonvoy Points per INR 150 for expenditures at participating Marriott Bonvoy and Marriott-branded establishments will not be eligible to receive an extra four Marriott Bonvoy Points within this specific earning category.

For all other qualifying transactions, excluding those associated with fuel, wallet reloads, and rentals, customers using the card can accumulate two Marriott Bonvoy points for every INR 150 spent. The card additionally offers complimentary access to domestic and international lounges annually, along with a personal air accident insurance cover at no cost.

Discussing the potential, Rao said, “Post the convergence, we have in excess of 100 million customers across India. We have 17-18 million credit cards and therefore see a massive opportunity to grow. The Marriott Bonvoy will be one of our several offerings to our premium customers, catering to those who are discerning and focused on travel.”

A month prior to this, HDFC Bank and Swiggy introduced the Swiggy HDFC Bank co-branded credit card, which is hosted on Mastercard’s payment network. The credit card aims to provide cardholders with rewards and benefits across various online platforms, with a particular focus on Swiggy.

Read More: Swiggy and HDFC Bank unveil co-branded credit card with Mastercard network; launch within 7-10 days

Also Read: Zomato and RBL Bank to end co-branded credit card partnership, users to receive new cards